Ct business entity tax due date ~ 31 2018 meaning that the next time the business entity tax is due is April 15 2019. Online filing is mandatory.

as we know it lately has been hunted by users around us, maybe one of you. People now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the title of this post I will discuss about Ct Business Entity Tax Due Date Online filing is mandatory.

If you are searching for Ct Business Entity Tax Due Date you've arrived at the right location. We have 20 images about ct business entity tax due date including images, pictures, photos, wallpapers, and more. In these page, we also have variety of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Ct business entity tax due date

Collection of Ct business entity tax due date ~ Ad Incorporation HR Payroll Tax Accounting Bookkeeping Cheapest. Ad Incorporation HR Payroll Tax Accounting Bookkeeping Cheapest. Ad Incorporation HR Payroll Tax Accounting Bookkeeping Cheapest. Ad Incorporation HR Payroll Tax Accounting Bookkeeping Cheapest. The due dates are. The due dates are. The due dates are. The due dates are. Taxpayers that want to close their BET account must first dissolve with the Secretary of State and file a final return. Taxpayers that want to close their BET account must first dissolve with the Secretary of State and file a final return. Taxpayers that want to close their BET account must first dissolve with the Secretary of State and file a final return. Taxpayers that want to close their BET account must first dissolve with the Secretary of State and file a final return.

Limited liability companies LLCs or SMLLCs that are for federal income tax. Limited liability companies LLCs or SMLLCs that are for federal income tax. Limited liability companies LLCs or SMLLCs that are for federal income tax. Limited liability companies LLCs or SMLLCs that are for federal income tax. In the state of Connecticut the LLCs had two main options for paying business entity tax. In the state of Connecticut the LLCs had two main options for paying business entity tax. In the state of Connecticut the LLCs had two main options for paying business entity tax. In the state of Connecticut the LLCs had two main options for paying business entity tax. Ad Hier geht es zu unserem aktuell besten Preis für Dein Wunschprodukt. Ad Hier geht es zu unserem aktuell besten Preis für Dein Wunschprodukt. Ad Hier geht es zu unserem aktuell besten Preis für Dein Wunschprodukt. Ad Hier geht es zu unserem aktuell besten Preis für Dein Wunschprodukt.

Last business day of anniversary month of filing Certificate of Incorporation or issuance of Certificate of Authority. Last business day of anniversary month of filing Certificate of Incorporation or issuance of Certificate of Authority. Last business day of anniversary month of filing Certificate of Incorporation or issuance of Certificate of Authority. Last business day of anniversary month of filing Certificate of Incorporation or issuance of Certificate of Authority. Form CT-990T ES for returns due between March 15 2020 and July 15 2020 07152020. Form CT-990T ES for returns due between March 15 2020 and July 15 2020 07152020. Form CT-990T ES for returns due between March 15 2020 and July 15 2020 07152020. Form CT-990T ES for returns due between March 15 2020 and July 15 2020 07152020. We develop postpandemic strategies such as disappearing financially. We develop postpandemic strategies such as disappearing financially. We develop postpandemic strategies such as disappearing financially. We develop postpandemic strategies such as disappearing financially.

Filing date extended to June 15 2020. Filing date extended to June 15 2020. Filing date extended to June 15 2020. Filing date extended to June 15 2020. Payment deadline extended to June 15 2020. Payment deadline extended to June 15 2020. Payment deadline extended to June 15 2020. Payment deadline extended to June 15 2020. Beginning in 2018 Pass-Through Entities will have to make estimated tax payments. Beginning in 2018 Pass-Through Entities will have to make estimated tax payments. Beginning in 2018 Pass-Through Entities will have to make estimated tax payments. Beginning in 2018 Pass-Through Entities will have to make estimated tax payments.

The law generally requires that each payment be 225 of the entities tax. The law generally requires that each payment be 225 of the entities tax. The law generally requires that each payment be 225 of the entities tax. The law generally requires that each payment be 225 of the entities tax. Business Entity Tax The Business Entity Tax BET is a 250 tax due every other taxable year and is imposed on the following business types. Business Entity Tax The Business Entity Tax BET is a 250 tax due every other taxable year and is imposed on the following business types. Business Entity Tax The Business Entity Tax BET is a 250 tax due every other taxable year and is imposed on the following business types. Business Entity Tax The Business Entity Tax BET is a 250 tax due every other taxable year and is imposed on the following business types. When is Form OP-424 due. When is Form OP-424 due. When is Form OP-424 due. When is Form OP-424 due.

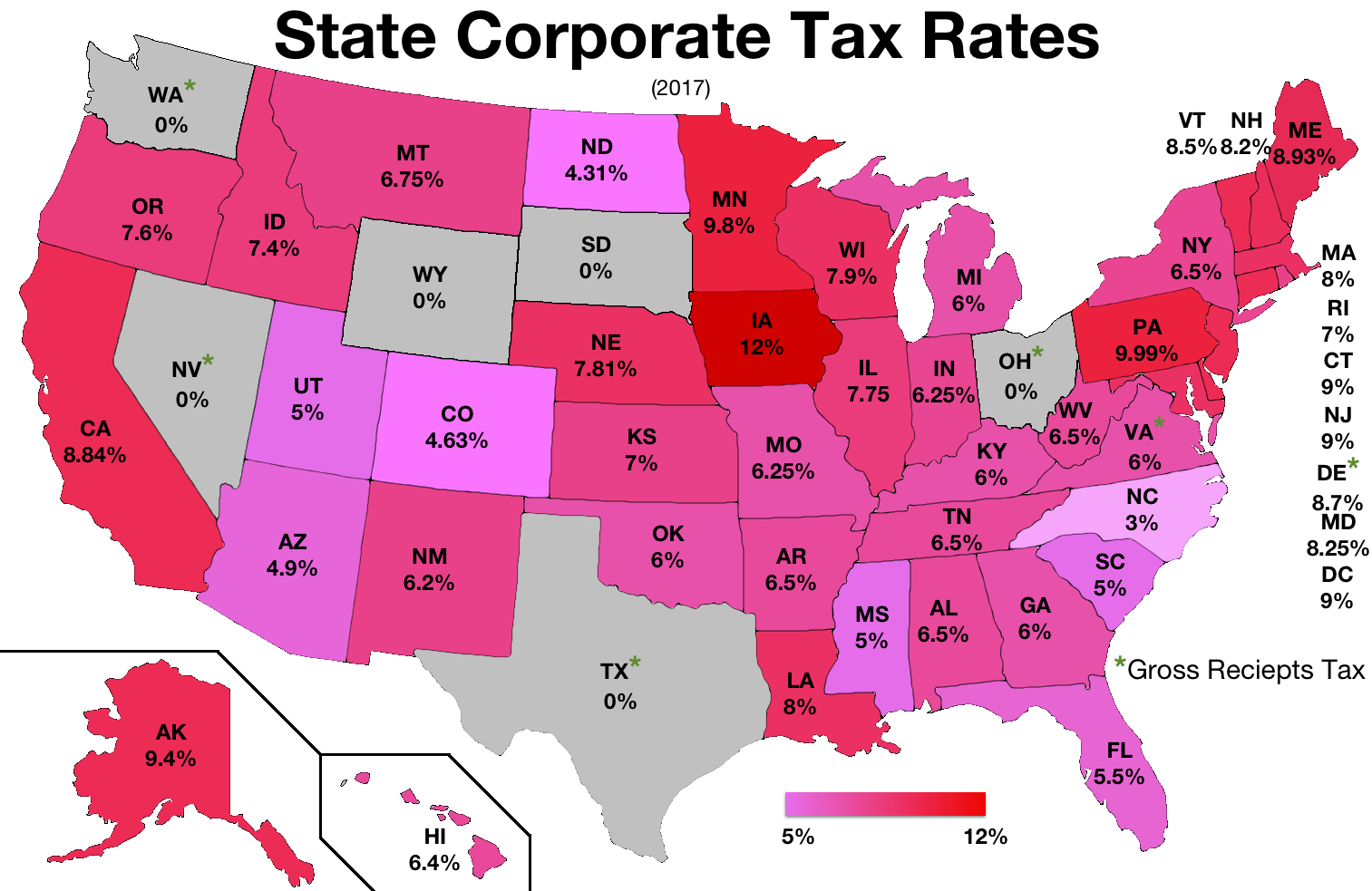

Visit the DRS website at wwwctgovDRS and select the TSC logo. Visit the DRS website at wwwctgovDRS and select the TSC logo. Visit the DRS website at wwwctgovDRS and select the TSC logo. Visit the DRS website at wwwctgovDRS and select the TSC logo. Filing date extended to June. Filing date extended to June. Filing date extended to June. Filing date extended to June. Corporate tax returns are due and taxes are payable on the 15th day of the fourth month after the end of the companys fiscal or financial year. Corporate tax returns are due and taxes are payable on the 15th day of the fourth month after the end of the companys fiscal or financial year. Corporate tax returns are due and taxes are payable on the 15th day of the fourth month after the end of the companys fiscal or financial year. Corporate tax returns are due and taxes are payable on the 15th day of the fourth month after the end of the companys fiscal or financial year.

Payment deadline extended to June 15 2020 2019 Form CT-990T Connecticut Unrelated Business Income Tax Return. Payment deadline extended to June 15 2020 2019 Form CT-990T Connecticut Unrelated Business Income Tax Return. Payment deadline extended to June 15 2020 2019 Form CT-990T Connecticut Unrelated Business Income Tax Return. Payment deadline extended to June 15 2020 2019 Form CT-990T Connecticut Unrelated Business Income Tax Return. For tax years beginning on or after January 1 2013 the business entity tax is due every other year. For tax years beginning on or after January 1 2013 the business entity tax is due every other year. For tax years beginning on or after January 1 2013 the business entity tax is due every other year. For tax years beginning on or after January 1 2013 the business entity tax is due every other year. Four payments of 225 would be 90 of the entities estimated tax liability. Four payments of 225 would be 90 of the entities estimated tax liability. Four payments of 225 would be 90 of the entities estimated tax liability. Four payments of 225 would be 90 of the entities estimated tax liability.

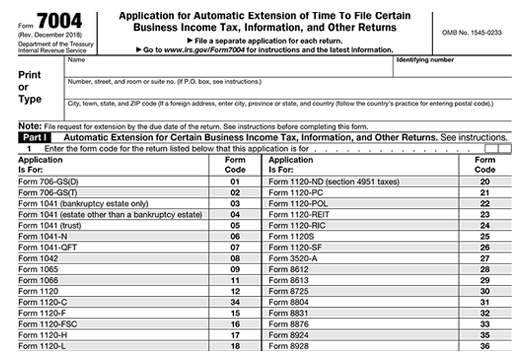

You can request a six month extension of time to file by filing Form CT-1065CT-1120SI EXT Application for Extension of Time to File Connecticut Pass-Through Entity Tax Return prior to the due date of your return. You can request a six month extension of time to file by filing Form CT-1065CT-1120SI EXT Application for Extension of Time to File Connecticut Pass-Through Entity Tax Return prior to the due date of your return. You can request a six month extension of time to file by filing Form CT-1065CT-1120SI EXT Application for Extension of Time to File Connecticut Pass-Through Entity Tax Return prior to the due date of your return. You can request a six month extension of time to file by filing Form CT-1065CT-1120SI EXT Application for Extension of Time to File Connecticut Pass-Through Entity Tax Return prior to the due date of your return. 2019 Form CT-1065CT-1120 SI Connecticut Pass-Through Entity Tax Return. 2019 Form CT-1065CT-1120 SI Connecticut Pass-Through Entity Tax Return. 2019 Form CT-1065CT-1120 SI Connecticut Pass-Through Entity Tax Return. 2019 Form CT-1065CT-1120 SI Connecticut Pass-Through Entity Tax Return. 1 für den besten Preis. 1 für den besten Preis. 1 für den besten Preis. 1 für den besten Preis.

Business Entity Tax Return. Business Entity Tax Return. Business Entity Tax Return. Business Entity Tax Return. 1 für den besten Preis. 1 für den besten Preis. 1 für den besten Preis. 1 für den besten Preis. Earlier this year the Connecticut legislature repealed the biannual business entity tax BET of 250 for years commencing on or after January 1 2020. Earlier this year the Connecticut legislature repealed the biannual business entity tax BET of 250 for years commencing on or after January 1 2020. Earlier this year the Connecticut legislature repealed the biannual business entity tax BET of 250 for years commencing on or after January 1 2020. Earlier this year the Connecticut legislature repealed the biannual business entity tax BET of 250 for years commencing on or after January 1 2020.

For calendar year filers your return is due on March 15 th. For calendar year filers your return is due on March 15 th. For calendar year filers your return is due on March 15 th. For calendar year filers your return is due on March 15 th. S corporations Qualified subchapter S subsidiaries QSSS are not liable for the BET. S corporations Qualified subchapter S subsidiaries QSSS are not liable for the BET. S corporations Qualified subchapter S subsidiaries QSSS are not liable for the BET. S corporations Qualified subchapter S subsidiaries QSSS are not liable for the BET. Payment deadline extended to June 15 2020. Payment deadline extended to June 15 2020. Payment deadline extended to June 15 2020. Payment deadline extended to June 15 2020.

Please visit the DRS website which includes a page with Frequently Asked Questions FAQ that is updated regularly. Please visit the DRS website which includes a page with Frequently Asked Questions FAQ that is updated regularly. Please visit the DRS website which includes a page with Frequently Asked Questions FAQ that is updated regularly. Please visit the DRS website which includes a page with Frequently Asked Questions FAQ that is updated regularly. Your Connecticut return is due on the fifteenth day of the third month following the end of your taxable year. Your Connecticut return is due on the fifteenth day of the third month following the end of your taxable year. Your Connecticut return is due on the fifteenth day of the third month following the end of your taxable year. Your Connecticut return is due on the fifteenth day of the third month following the end of your taxable year. Friday January 31 2020. Friday January 31 2020. Friday January 31 2020. Friday January 31 2020.

Tuesday March 31 2020. Tuesday March 31 2020. Tuesday March 31 2020. Tuesday March 31 2020. 1 2017 and will end on Dec. 1 2017 and will end on Dec. 1 2017 and will end on Dec. 1 2017 and will end on Dec. Filing date extended to April 15 2020. Filing date extended to April 15 2020. Filing date extended to April 15 2020. Filing date extended to April 15 2020.

Your business must pay this tax by April 15 after the end of the biennial period. Your business must pay this tax by April 15 after the end of the biennial period. Your business must pay this tax by April 15 after the end of the biennial period. Your business must pay this tax by April 15 after the end of the biennial period. Ad Escape entirely from greedy governments without moving to a desert. Ad Escape entirely from greedy governments without moving to a desert. Ad Escape entirely from greedy governments without moving to a desert. Ad Escape entirely from greedy governments without moving to a desert. Ad Hier geht es zu unserem aktuell besten Preis für Dein Wunschprodukt. Ad Hier geht es zu unserem aktuell besten Preis für Dein Wunschprodukt. Ad Hier geht es zu unserem aktuell besten Preis für Dein Wunschprodukt. Ad Hier geht es zu unserem aktuell besten Preis für Dein Wunschprodukt.

Filing date extended to April 15 2020. Filing date extended to April 15 2020. Filing date extended to April 15 2020. Filing date extended to April 15 2020. Ad Incorporation HR Payroll Tax Accounting Bookkeeping Cheapest. Ad Incorporation HR Payroll Tax Accounting Bookkeeping Cheapest. Ad Incorporation HR Payroll Tax Accounting Bookkeeping Cheapest. Ad Incorporation HR Payroll Tax Accounting Bookkeeping Cheapest. A business entitys taxable year is its. A business entitys taxable year is its. A business entitys taxable year is its. A business entitys taxable year is its.

Ad Über 7 Millionen englische Bücher. Ad Über 7 Millionen englische Bücher. Ad Über 7 Millionen englische Bücher. Ad Über 7 Millionen englische Bücher. When it was still around the due date of this business entity tax or BET used to depend on when the business entitys taxable year ended. When it was still around the due date of this business entity tax or BET used to depend on when the business entitys taxable year ended. When it was still around the due date of this business entity tax or BET used to depend on when the business entitys taxable year ended. When it was still around the due date of this business entity tax or BET used to depend on when the business entitys taxable year ended. Doesnt seem that long ago. Doesnt seem that long ago. Doesnt seem that long ago. Doesnt seem that long ago.

The Connecticut business entity tax is a tax that is due on odd years. The Connecticut business entity tax is a tax that is due on odd years. The Connecticut business entity tax is a tax that is due on odd years. The Connecticut business entity tax is a tax that is due on odd years. Idealo ist Deutschlands größter Preisvergleich - die Nr. Idealo ist Deutschlands größter Preisvergleich - die Nr. Idealo ist Deutschlands größter Preisvergleich - die Nr. Idealo ist Deutschlands größter Preisvergleich - die Nr. Last business day of anniversary month of incorporation or qualification. Last business day of anniversary month of incorporation or qualification. Last business day of anniversary month of incorporation or qualification. Last business day of anniversary month of incorporation or qualification.

2019 Form CT-990T Connecticut Unrelated Business Income Tax Return. 2019 Form CT-990T Connecticut Unrelated Business Income Tax Return. 2019 Form CT-990T Connecticut Unrelated Business Income Tax Return. 2019 Form CT-990T Connecticut Unrelated Business Income Tax Return. This is generally the safe-harbor provision to avoid any underestimated tax penalty. This is generally the safe-harbor provision to avoid any underestimated tax penalty. This is generally the safe-harbor provision to avoid any underestimated tax penalty. This is generally the safe-harbor provision to avoid any underestimated tax penalty. Ad Escape entirely from greedy governments without moving to a desert. Ad Escape entirely from greedy governments without moving to a desert. Ad Escape entirely from greedy governments without moving to a desert. Ad Escape entirely from greedy governments without moving to a desert.

What Was the Tax Anyway. What Was the Tax Anyway. What Was the Tax Anyway. What Was the Tax Anyway. Sunsets business entity tax Upon passage but applies beginning January 1 2020. Sunsets business entity tax Upon passage but applies beginning January 1 2020. Sunsets business entity tax Upon passage but applies beginning January 1 2020. Sunsets business entity tax Upon passage but applies beginning January 1 2020. Business Tax Fee Changes Provision Effective Date 338 339 Business Entity Tax. Business Tax Fee Changes Provision Effective Date 338 339 Business Entity Tax. Business Tax Fee Changes Provision Effective Date 338 339 Business Entity Tax. Business Tax Fee Changes Provision Effective Date 338 339 Business Entity Tax.

We develop postpandemic strategies such as disappearing financially. We develop postpandemic strategies such as disappearing financially. We develop postpandemic strategies such as disappearing financially. We develop postpandemic strategies such as disappearing financially. Ad Über 7 Millionen englische Bücher. Ad Über 7 Millionen englische Bücher. Ad Über 7 Millionen englische Bücher. Ad Über 7 Millionen englische Bücher. The return and payment are due on or before the fifteenth day of the fourth month April 15 for calendar year filers following the close of every other taxable year of the business entity. The return and payment are due on or before the fifteenth day of the fourth month April 15 for calendar year filers following the close of every other taxable year of the business entity. The return and payment are due on or before the fifteenth day of the fourth month April 15 for calendar year filers following the close of every other taxable year of the business entity. The return and payment are due on or before the fifteenth day of the fourth month April 15 for calendar year filers following the close of every other taxable year of the business entity.

26 mills in 2021 21 mills in 2022 11. 26 mills in 2021 21 mills in 2022 11. 26 mills in 2021 21 mills in 2022 11. 26 mills in 2021 21 mills in 2022 11. Phases out capital base tax over four years. Phases out capital base tax over four years. Phases out capital base tax over four years. Phases out capital base tax over four years. For example a corporation with a year-end date of December 31 must file and pay taxes by April 15. For example a corporation with a year-end date of December 31 must file and pay taxes by April 15. For example a corporation with a year-end date of December 31 must file and pay taxes by April 15. For example a corporation with a year-end date of December 31 must file and pay taxes by April 15.

The current biennial period started on Jan. The current biennial period started on Jan. The current biennial period started on Jan. The current biennial period started on Jan. Conforming change is effective January 1 2020 340 Capital Base Tax. Conforming change is effective January 1 2020 340 Capital Base Tax. Conforming change is effective January 1 2020 340 Capital Base Tax. Conforming change is effective January 1 2020 340 Capital Base Tax. Idealo ist Deutschlands größter Preisvergleich - die Nr. Idealo ist Deutschlands größter Preisvergleich - die Nr. Idealo ist Deutschlands größter Preisvergleich - die Nr. Idealo ist Deutschlands größter Preisvergleich - die Nr.

2019 Form CT-1065CT-1120 SI Connecticut Pass-Though Entity Tax Return. 2019 Form CT-1065CT-1120 SI Connecticut Pass-Though Entity Tax Return. 2019 Form CT-1065CT-1120 SI Connecticut Pass-Though Entity Tax Return. 2019 Form CT-1065CT-1120 SI Connecticut Pass-Though Entity Tax Return. Unrelated Business Income Tax Estimated Payments. Unrelated Business Income Tax Estimated Payments. Unrelated Business Income Tax Estimated Payments. Unrelated Business Income Tax Estimated Payments. The last time the BET was paid was April 12 2019. The last time the BET was paid was April 12 2019. The last time the BET was paid was April 12 2019. The last time the BET was paid was April 12 2019.

Monday March 2 2020. Monday March 2 2020. Monday March 2 2020. Monday March 2 2020.

Pdf Small Business Taxation

Source Image @ www.researchgate.net

Ct business entity tax due date | Pdf Small Business Taxation

Collection of Ct business entity tax due date ~ Ad Incorporation HR Payroll Tax Accounting Bookkeeping Cheapest. Ad Incorporation HR Payroll Tax Accounting Bookkeeping Cheapest. Ad Incorporation HR Payroll Tax Accounting Bookkeeping Cheapest. The due dates are. The due dates are. The due dates are. Taxpayers that want to close their BET account must first dissolve with the Secretary of State and file a final return. Taxpayers that want to close their BET account must first dissolve with the Secretary of State and file a final return. Taxpayers that want to close their BET account must first dissolve with the Secretary of State and file a final return.

Limited liability companies LLCs or SMLLCs that are for federal income tax. Limited liability companies LLCs or SMLLCs that are for federal income tax. Limited liability companies LLCs or SMLLCs that are for federal income tax. In the state of Connecticut the LLCs had two main options for paying business entity tax. In the state of Connecticut the LLCs had two main options for paying business entity tax. In the state of Connecticut the LLCs had two main options for paying business entity tax. Ad Hier geht es zu unserem aktuell besten Preis für Dein Wunschprodukt. Ad Hier geht es zu unserem aktuell besten Preis für Dein Wunschprodukt. Ad Hier geht es zu unserem aktuell besten Preis für Dein Wunschprodukt.

Last business day of anniversary month of filing Certificate of Incorporation or issuance of Certificate of Authority. Last business day of anniversary month of filing Certificate of Incorporation or issuance of Certificate of Authority. Last business day of anniversary month of filing Certificate of Incorporation or issuance of Certificate of Authority. Form CT-990T ES for returns due between March 15 2020 and July 15 2020 07152020. Form CT-990T ES for returns due between March 15 2020 and July 15 2020 07152020. Form CT-990T ES for returns due between March 15 2020 and July 15 2020 07152020. We develop postpandemic strategies such as disappearing financially. We develop postpandemic strategies such as disappearing financially. We develop postpandemic strategies such as disappearing financially.

Filing date extended to June 15 2020. Filing date extended to June 15 2020. Filing date extended to June 15 2020. Payment deadline extended to June 15 2020. Payment deadline extended to June 15 2020. Payment deadline extended to June 15 2020. Beginning in 2018 Pass-Through Entities will have to make estimated tax payments. Beginning in 2018 Pass-Through Entities will have to make estimated tax payments. Beginning in 2018 Pass-Through Entities will have to make estimated tax payments.

The law generally requires that each payment be 225 of the entities tax. The law generally requires that each payment be 225 of the entities tax. The law generally requires that each payment be 225 of the entities tax. Business Entity Tax The Business Entity Tax BET is a 250 tax due every other taxable year and is imposed on the following business types. Business Entity Tax The Business Entity Tax BET is a 250 tax due every other taxable year and is imposed on the following business types. Business Entity Tax The Business Entity Tax BET is a 250 tax due every other taxable year and is imposed on the following business types. When is Form OP-424 due. When is Form OP-424 due. When is Form OP-424 due.

Visit the DRS website at wwwctgovDRS and select the TSC logo. Visit the DRS website at wwwctgovDRS and select the TSC logo. Visit the DRS website at wwwctgovDRS and select the TSC logo. Filing date extended to June. Filing date extended to June. Filing date extended to June. Corporate tax returns are due and taxes are payable on the 15th day of the fourth month after the end of the companys fiscal or financial year. Corporate tax returns are due and taxes are payable on the 15th day of the fourth month after the end of the companys fiscal or financial year. Corporate tax returns are due and taxes are payable on the 15th day of the fourth month after the end of the companys fiscal or financial year.

Payment deadline extended to June 15 2020 2019 Form CT-990T Connecticut Unrelated Business Income Tax Return. Payment deadline extended to June 15 2020 2019 Form CT-990T Connecticut Unrelated Business Income Tax Return. Payment deadline extended to June 15 2020 2019 Form CT-990T Connecticut Unrelated Business Income Tax Return. For tax years beginning on or after January 1 2013 the business entity tax is due every other year. For tax years beginning on or after January 1 2013 the business entity tax is due every other year. For tax years beginning on or after January 1 2013 the business entity tax is due every other year. Four payments of 225 would be 90 of the entities estimated tax liability. Four payments of 225 would be 90 of the entities estimated tax liability. Four payments of 225 would be 90 of the entities estimated tax liability.

You can request a six month extension of time to file by filing Form CT-1065CT-1120SI EXT Application for Extension of Time to File Connecticut Pass-Through Entity Tax Return prior to the due date of your return. You can request a six month extension of time to file by filing Form CT-1065CT-1120SI EXT Application for Extension of Time to File Connecticut Pass-Through Entity Tax Return prior to the due date of your return. You can request a six month extension of time to file by filing Form CT-1065CT-1120SI EXT Application for Extension of Time to File Connecticut Pass-Through Entity Tax Return prior to the due date of your return. 2019 Form CT-1065CT-1120 SI Connecticut Pass-Through Entity Tax Return. 2019 Form CT-1065CT-1120 SI Connecticut Pass-Through Entity Tax Return. 2019 Form CT-1065CT-1120 SI Connecticut Pass-Through Entity Tax Return. 1 für den besten Preis. 1 für den besten Preis. 1 für den besten Preis.

Business Entity Tax Return. Business Entity Tax Return. Business Entity Tax Return. 1 für den besten Preis. 1 für den besten Preis. 1 für den besten Preis. Earlier this year the Connecticut legislature repealed the biannual business entity tax BET of 250 for years commencing on or after January 1 2020. Earlier this year the Connecticut legislature repealed the biannual business entity tax BET of 250 for years commencing on or after January 1 2020. Earlier this year the Connecticut legislature repealed the biannual business entity tax BET of 250 for years commencing on or after January 1 2020.

For calendar year filers your return is due on March 15 th. For calendar year filers your return is due on March 15 th. For calendar year filers your return is due on March 15 th. S corporations Qualified subchapter S subsidiaries QSSS are not liable for the BET. S corporations Qualified subchapter S subsidiaries QSSS are not liable for the BET. S corporations Qualified subchapter S subsidiaries QSSS are not liable for the BET. Payment deadline extended to June 15 2020. Payment deadline extended to June 15 2020. Payment deadline extended to June 15 2020.

Please visit the DRS website which includes a page with Frequently Asked Questions FAQ that is updated regularly. Please visit the DRS website which includes a page with Frequently Asked Questions FAQ that is updated regularly. Please visit the DRS website which includes a page with Frequently Asked Questions FAQ that is updated regularly. Your Connecticut return is due on the fifteenth day of the third month following the end of your taxable year. Your Connecticut return is due on the fifteenth day of the third month following the end of your taxable year. Your Connecticut return is due on the fifteenth day of the third month following the end of your taxable year. Friday January 31 2020. Friday January 31 2020. Friday January 31 2020.

Tuesday March 31 2020. Tuesday March 31 2020. Tuesday March 31 2020. 1 2017 and will end on Dec. 1 2017 and will end on Dec. 1 2017 and will end on Dec. Filing date extended to April 15 2020. Filing date extended to April 15 2020. Filing date extended to April 15 2020.

Your business must pay this tax by April 15 after the end of the biennial period. Your business must pay this tax by April 15 after the end of the biennial period. Your business must pay this tax by April 15 after the end of the biennial period. Ad Escape entirely from greedy governments without moving to a desert. Ad Escape entirely from greedy governments without moving to a desert. Ad Escape entirely from greedy governments without moving to a desert. Ad Hier geht es zu unserem aktuell besten Preis für Dein Wunschprodukt. Ad Hier geht es zu unserem aktuell besten Preis für Dein Wunschprodukt. Ad Hier geht es zu unserem aktuell besten Preis für Dein Wunschprodukt.

Filing date extended to April 15 2020. Filing date extended to April 15 2020. Filing date extended to April 15 2020. Ad Incorporation HR Payroll Tax Accounting Bookkeeping Cheapest. Ad Incorporation HR Payroll Tax Accounting Bookkeeping Cheapest. Ad Incorporation HR Payroll Tax Accounting Bookkeeping Cheapest. A business entitys taxable year is its. A business entitys taxable year is its. A business entitys taxable year is its.

Ad Über 7 Millionen englische Bücher. Ad Über 7 Millionen englische Bücher. Ad Über 7 Millionen englische Bücher. When it was still around the due date of this business entity tax or BET used to depend on when the business entitys taxable year ended. When it was still around the due date of this business entity tax or BET used to depend on when the business entitys taxable year ended. When it was still around the due date of this business entity tax or BET used to depend on when the business entitys taxable year ended. Doesnt seem that long ago. Doesnt seem that long ago. Doesnt seem that long ago.

The Connecticut business entity tax is a tax that is due on odd years. The Connecticut business entity tax is a tax that is due on odd years. The Connecticut business entity tax is a tax that is due on odd years. Idealo ist Deutschlands größter Preisvergleich - die Nr. Idealo ist Deutschlands größter Preisvergleich - die Nr. Idealo ist Deutschlands größter Preisvergleich - die Nr. Last business day of anniversary month of incorporation or qualification. Last business day of anniversary month of incorporation or qualification. Last business day of anniversary month of incorporation or qualification.

2019 Form CT-990T Connecticut Unrelated Business Income Tax Return. 2019 Form CT-990T Connecticut Unrelated Business Income Tax Return. 2019 Form CT-990T Connecticut Unrelated Business Income Tax Return. This is generally the safe-harbor provision to avoid any underestimated tax penalty. This is generally the safe-harbor provision to avoid any underestimated tax penalty. This is generally the safe-harbor provision to avoid any underestimated tax penalty. Ad Escape entirely from greedy governments without moving to a desert. Ad Escape entirely from greedy governments without moving to a desert. Ad Escape entirely from greedy governments without moving to a desert.

What Was the Tax Anyway. What Was the Tax Anyway. What Was the Tax Anyway. Sunsets business entity tax Upon passage but applies beginning January 1 2020. Sunsets business entity tax Upon passage but applies beginning January 1 2020. Sunsets business entity tax Upon passage but applies beginning January 1 2020. Business Tax Fee Changes Provision Effective Date 338 339 Business Entity Tax. Business Tax Fee Changes Provision Effective Date 338 339 Business Entity Tax. Business Tax Fee Changes Provision Effective Date 338 339 Business Entity Tax.

We develop postpandemic strategies such as disappearing financially. We develop postpandemic strategies such as disappearing financially. We develop postpandemic strategies such as disappearing financially. Ad Über 7 Millionen englische Bücher. Ad Über 7 Millionen englische Bücher. Ad Über 7 Millionen englische Bücher. The return and payment are due on or before the fifteenth day of the fourth month April 15 for calendar year filers following the close of every other taxable year of the business entity. The return and payment are due on or before the fifteenth day of the fourth month April 15 for calendar year filers following the close of every other taxable year of the business entity. The return and payment are due on or before the fifteenth day of the fourth month April 15 for calendar year filers following the close of every other taxable year of the business entity.

26 mills in 2021 21 mills in 2022 11. 26 mills in 2021 21 mills in 2022 11. 26 mills in 2021 21 mills in 2022 11. Phases out capital base tax over four years. Phases out capital base tax over four years. Phases out capital base tax over four years. For example a corporation with a year-end date of December 31 must file and pay taxes by April 15. For example a corporation with a year-end date of December 31 must file and pay taxes by April 15. For example a corporation with a year-end date of December 31 must file and pay taxes by April 15.

The current biennial period started on Jan. The current biennial period started on Jan. The current biennial period started on Jan. Conforming change is effective January 1 2020 340 Capital Base Tax. Conforming change is effective January 1 2020 340 Capital Base Tax. Conforming change is effective January 1 2020 340 Capital Base Tax. Idealo ist Deutschlands größter Preisvergleich - die Nr. Idealo ist Deutschlands größter Preisvergleich - die Nr. Idealo ist Deutschlands größter Preisvergleich - die Nr.

2019 Form CT-1065CT-1120 SI Connecticut Pass-Though Entity Tax Return. 2019 Form CT-1065CT-1120 SI Connecticut Pass-Though Entity Tax Return. 2019 Form CT-1065CT-1120 SI Connecticut Pass-Though Entity Tax Return. Unrelated Business Income Tax Estimated Payments. Unrelated Business Income Tax Estimated Payments. Unrelated Business Income Tax Estimated Payments.

Account Suspended Accounting Tax Preparation Finance

Source Image @ ro.pinterest.com

Corporation Tax In The Republic Of Ireland Wikiwand

Source Image @ www.wikiwand.com

Llc Tax Calculator Definitive Small Business Tax Estimator

Source Image @ beforetax.co

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

Source Image @ www.indinero.com